Hey, Lancaster County Friends! We’re heading into the end of 2023, and what is happening with Real Estate? Is the market slowing down? Are prices going to fall? Let’s take a look at what’s been happening and where we are headed.

Lancaster County Local Market

For Lancaster County, we have seen our list-price-to-closed price stay over 100%. This means that homes are selling for more than their list price. And home prices continue to creep up. Our average sold price in January of this year was $331,723 and for the month of September the average sold price was $357,501. That’s almost an 8% increase.

What Experts Say

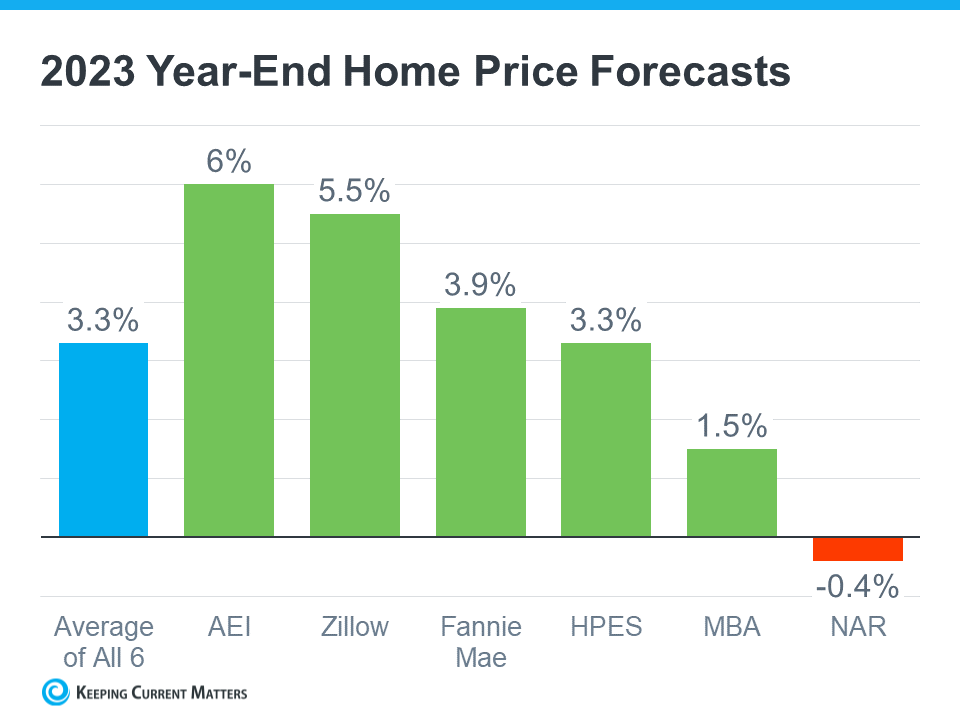

First, let’s take a look at what experts are predicting. Out of 7 industry experts, six of them are predicting that home prices are going to continue to appreciate this year, with Zillow saying appreciation will be 5.5%. A large survey from over 100 economists predicts an average of 3.3% appreciation.

Inventory is the Driver

At this point, no one is predicting a crash of the real estate market. In fact, it’s holding strong. The reason for this is that our supply of homes is still too low. We have many more buyers looking for homes than there are homes available! This is keeping the pressure on prices. Today as I record this, there are only 562 active residential listings in Lancaster County, and 377 if we eliminate new construction. For the last three months, we have sold an average of 445 houses every month. We divide the number of available homes for sale by the average amount sold and, using existing homes only, that means we have a 24-day supply.

How Do Interest Rates Affect Buyers?

Now let’s consider interest rates. Many buyers are worried about purchasing a home right now because of the higher interest rates. Their purchase power is lower than it was last year. Let’s look at an average home value of $350,000. If the buyer would have bought this home at 5% interest with 20% down, the monthly mortgage payment would have been $1941.85. If, however, they purchased the home with 8% interest rate, the payment would be $2493.29. That’s basically $500 more a month. So you can see how much the interest rate affects a buyer’s purchasing power.

What About Market Value?

Even though interest rates have increased, remember that market value is continuing to go up year over year. Unless the market crashes, right now is the cheapest you’ll get a home. In six months from now, it will cost you more. Next year it will cost even more.

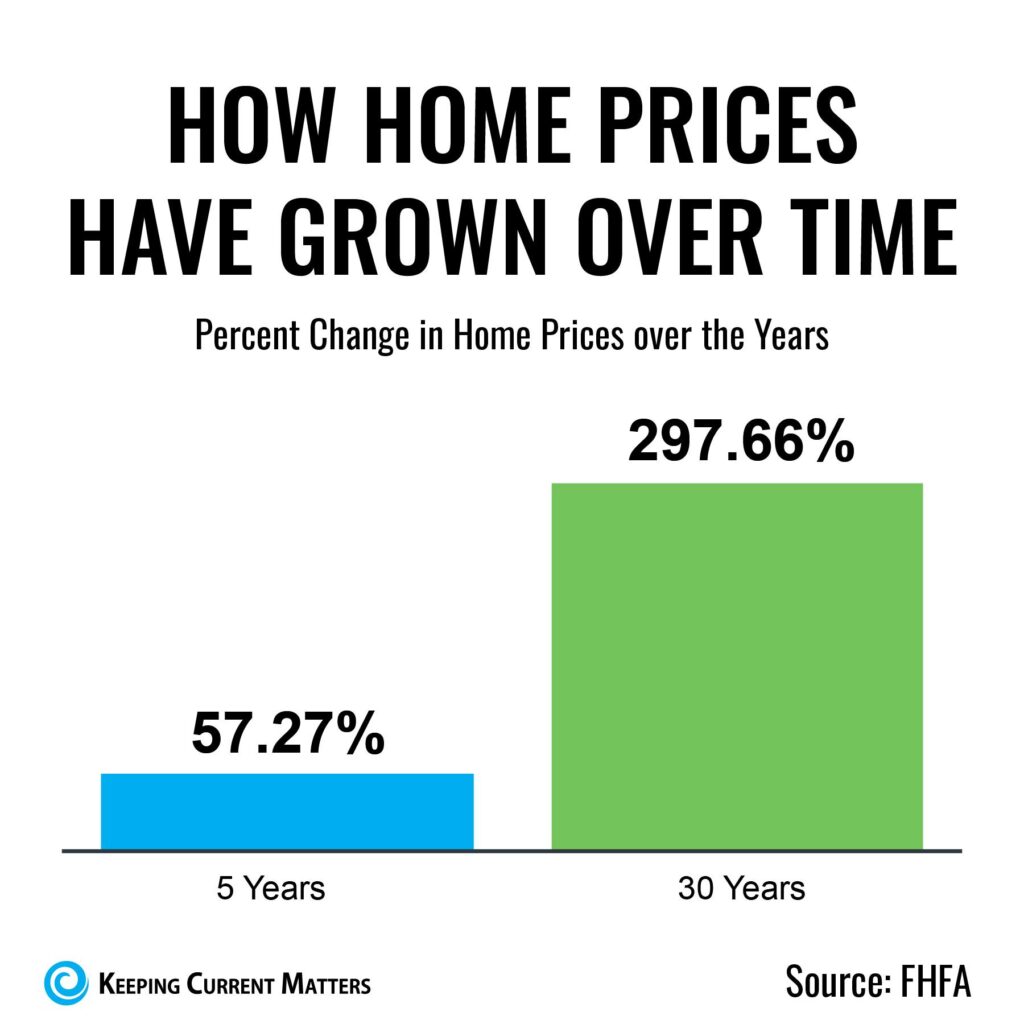

Take a look at this graph to see how home values have increased in the last 5 years and 30 years! That’s almost a 60% and 300% increase. So please don’t get so focused on interest rates that you miss the actual value of home ownership. Real estate is a time game. Over time you will gain equity and market value. So, the sooner you buy a home the better.

The Market Could Stabilize

I personally think the market will stabilize, but not crash. I do think people who don’t have a strong motivation to buy a home will probably hold off and wait. This could lessen the pressure in the inventory. However, if interest rates are lowered, we could see a lot of buyer’s entering the market again.

So is there ever a perfect time to buy and sell real estate? Well, actually, the perfect time is the time that is right for you. If you have questions about your situation, or about our local Lancaster County housing market, please reach out. I’m always happy to help.